The Veteran’s Guide to Debt and Investing

Whether you are active duty or a Veteran, starting your first job or well-established in your career, it is never too early to start repaying your debt and investing in retirement plans. I know that these topics can feel daunting. So I will be sharing a few of my strategies to pay off your debt and invest in your retirement.*

Part One: Pay Off Your Debt

The money that you borrow charges interest compounded daily. If you only pay the minimum, the debt will keep getting larger. Instead of throwing money at your debt every once in a while, you need a consistent plan to pay it off.

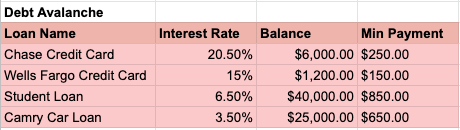

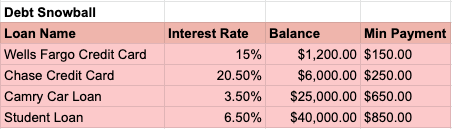

I recommend trying the “Debt Avalanche” or “Debt Snowball” methods.

If you have high-interest loans, list all your debts from highest to lowest interest rate. Pay all the minimums, and then pay all you can to the highest interest debts first. Once you’ve finished paying off one, continue down the list to the next highest and repeat the process until you’re debt-free.

If you have lots of loans with relatively small balances, try listing out all your debts from lowest to highest balance. Pay all the minimums, and then put all you can towards the loan with the lowest balance. Once that is paid off, continue down the list until you’re done.

Part Two: Invest to Retire

Investing is when you put away money now with the expectation (not the hope) that it will grow into more money later. This could be buying a house, paying for your kids’ education, and retiring one day.

The two retirement investment accounts you should start as soon as possible are an Employer-Sponsored Plan (ESP) and an Individual Retirement Account (IRA). When you begin these accounts, the younger you are, the more the investments will grow over time due to compound interest.

If you are employed full-time, you are eligible for an ESP for retirement, like a 401k, 403b, 457b, or TSP. When you contribute to an ESP, the money is taken directly from your paycheck to the plan. Employers may match your contributions up to a certain percentage, and you can contribute up to $20,500 per year in total.

You can start an IRA through a bank, brokerage company, or credit union if you max out your ESP. IRAs allow you to make financial contributions with tax advantages. You can contribute up to $6000 to an IRA per year and access these funds without financial penalties after 59.5 years old.

Both employer-sponsored and individual retirement accounts come in two flavors: Traditional and Roth.

Traditional contributions are not taxed until you use the funds later. The interest is taxable when it is withdrawn, and the tax rate depends on when you take it out.

Roth contributions are taxed when they go into the account. As a result, the interest and growth are never taxed. The tax rate on the contributions depends on where you earn them, so they are best if you believe you will have to pay more taxes when you withdraw your funds.

However you invest, you will likely go through Vanguard, Fidelity, or Charles Schwab. These big brokerage houses offer a target-date retirement fund, where they invest your money in a medium-risk combination of stocks and bonds. I recommend you start a target-date retirement fund, choose the year closest to when you want to retire, put your contributions into that fund, and walk away.

Part Three: Put Your Personal Finance Plan to Action

You should have everything you need to get started with taking control of your finances. I know this was a lot of information, so I have compiled a list of action items below. Consider assigning yourself the following homework:

- List out all your debts with the amount and interest rates, choose a strategy, and pay it off!

- Contribute to your workplace retirement plan and start a target-date retirement fund

- Open and contribute to an IRA and start a target-date retirement fund

- Choose between Roth and Traditional contributions

If you have any questions or want to receive personalized financial advice, please contact a financial advisor.

To learn about budgeting and the best banking options for the military community, check out my other blog post The Veteran’s Guide to Budgeting and Banking.

Jonathan is Code Platoon’s Director of Education and a Senior Software Engineer at Venmo. He has taught nearly every Code Platoon graduate personally and is dedicated to student success. Before Code Platoon, Jonathan taught special education math in Chicago’s Harper High School, which was featured on NPR’s “This American Life.” Jonathan received his BS from Northwestern University and his Masters’s degree in Teaching during his fellowship with Teach for America.

*Disclaimer: This guide is for informational purposes only. Neither Code Platoon nor I am giving you financial advice. Please contact a financial advisor if you have specific questions.