The Veteran’s Guide to Budgeting and Banking

According to the National Foundation for Credit Counseling (NFCC), eighty-six percent of Active Duty Servicemembers, fifty-one percent of military spouses, and forty-three percent of Veterans worry about their personal finances.

I have created this budgeting and banking guide for the military community with statistics like these in mind. If you are a Veteran, spouse, or Servicemember and aren’t sure how to make a budget, choose banking accounts, or save money for emergencies, I hope you find this guide helpful.*

Part One: Make Your Budget

At the heart of budgeting is a fundamental question: how much money do you earn and how much do you spend? Having a deep knowledge of your income and outflow is crucial to people of all financial backgrounds. I need a budget. You need a budget. Even celebrities need a budget.

A budget requires time to set up and implement. You can either set up your budget yourself in a spreadsheet or use software like You Need a Budget or Mint to get you started.

When you create your budget, I recommend choosing between a “Zero-based Budget” and “50/30/20 Budget” styles.

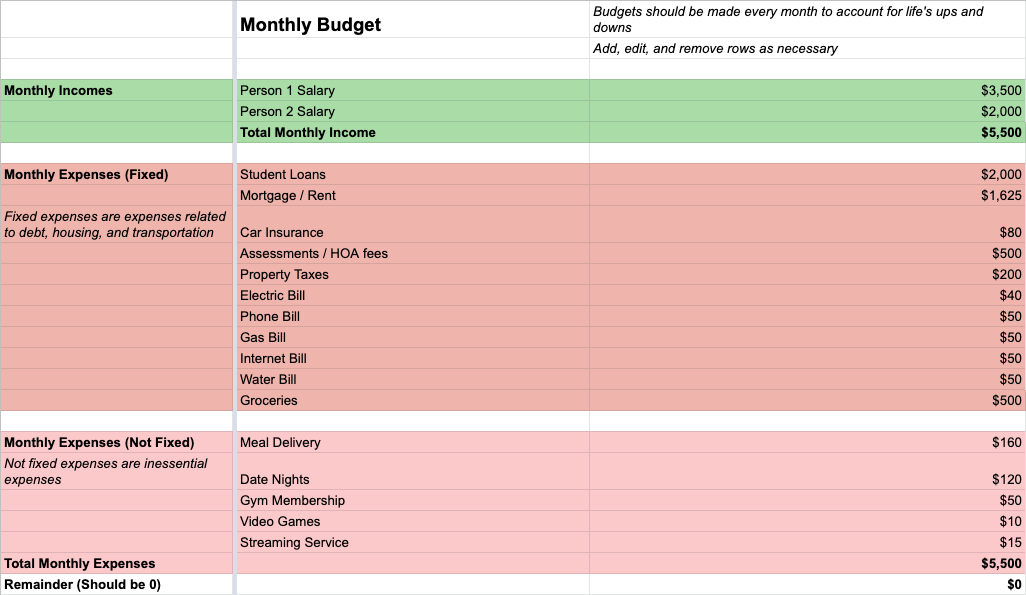

A Zero-based Budget is where you list your income and match it up against your expenses. Make adjustments until the income minus the costs equals zero.

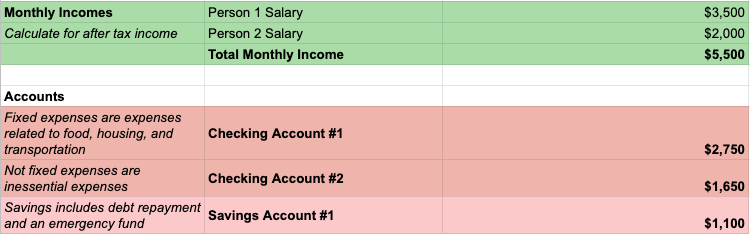

A 50/30/20 Budget is another option. For this budget, you will allocate your after-tax income between two checking accounts and a savings account as follows:

- 50% in Checking Account #1 for your fixed expenses like groceries and rent.

- 30% in Checking Account #2 for your inessential expenses like movies or dates.

- 20% in Savings Account #1 for your debt repayment and emergency fund.

Part Two: Open Banking Accounts

Whatever budget you end up making, you will need at least a checking account and a savings account in your daily life.

Use a checking account for your daily banking, like receiving paychecks and paying bills. As a member of the military community, you can open a checking account without any fees through USAA Bank for military members or Chase Military Banking.

Use a savings account to build savings for an emergency fund and pay off debt. Your emergency fund should be able to sustain your current lifestyle for three to six months. If that’s too big of a number, start with whatever you can and work your way up.

When you open a savings account, you want an Annual Percentage Yield (APY) of at least 0.5% interest. You can use Bankrate to check for the best available rates when you’re ready to open your savings account.

Part Three: Now do it Yourself!

It’s time to put these strategies to practice. You can follow the action items below to get started on your new budget and banking accounts:

- Create and follow either a Zero-based Budget or a 50/30/20 Budget

- Ensure you have a checking account with a bank that doesn’t charge fees

- Ensure you have a savings account that offers 0.5% APY or higher

- Come up with a plan to save an emergency fund able to cover at least three months’ expenses

If you have any questions or want to receive personalized financial advice, please contact a financial advisor.

Jonathan is Code Platoon’s Director of Education and a Senior Software Engineer at Venmo. He has taught nearly every Code Platoon graduate personally and is dedicated to student success. Before Code Platoon, Jonathan taught special education math in Chicago’s Harper High School, which was featured on NPR’s “This American Life.” Jonathan received his BS from Northwestern University and his Masters’s degree in Teaching during his fellowship with Teach for America.

*Disclaimer: This guide is for informational purposes only. Neither Code Platoon nor I am giving you financial advice. Please contact a financial advisor if you have specific questions.